IonQ and Oxford Ionics announced that they had entered into a definitive agreement for IonQ to acquire Oxford Ionics in a transaction valued at US$1.075 billion, the largest deal of its kind seen in the quantum computing industry to date. The transaction will consist mostly of US$1.065 billion in IonQ shares (representing around 10% of IonQ's market cap of ~US$10 billion at the time of writing) and approximately US$10 million in cash (source: IonQ press release).

This record-breaking deal represents a major consolidation of talent and resources in the quantum computing industry, a trend that IDTechEx has predicted to emerge as the industry matures and talent shortages become more pressing. Over the last decade, quantum computers have emerged from lab experiments to a burgeoning technology industry with IDTechEx forecasting the revenue from hardware sales alone to exceed US$10 billion by 2045 in their latest Quantum Computing Market report.

Quantum computing with trapped ions

Quantum computing is a revolutionary technology that uses quantum bits or 'qubits' to unlock new computational operations and offers the potential to solve certain problems exponentially faster than a conventional computer. The industries that could benefit from this speedup range from materials to finance to pharmaceuticals and more.

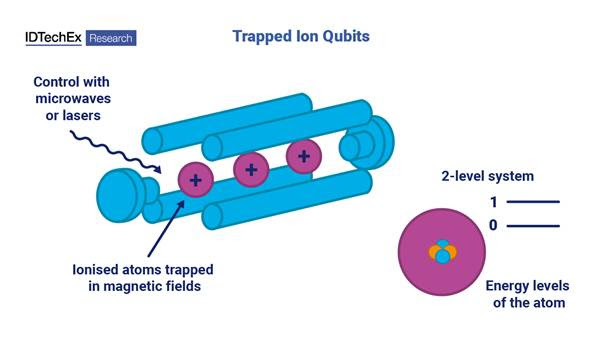

Trapped ion quantum computing is the approach taken by some of the market leaders in the industry, including IonQ and Quantinuum. It has been one of the biggest competitors to IBM's superconducting qubit approach so far. In the trapped ion approach, charged atoms (ions) such as strontium, ytterbium, or calcium are used to make qubits. The atoms have multiple energy states that can be used to form two-level systems needed to store quantum information. Specifically, hyperfine states are used, which have the advantage of very long lifetimes. As opposed to cryogenic cooling, these atoms are isolated from the environment using optical tweezers, a method that uses the minuscule forces from deflected light to keep the ions almost perfectly stationary.

Along with avoiding the need for cryogenics, another major advantage of the trapped ion platform is that the market leaders have demonstrated qubits with much higher fidelity than others, which could significantly reduce the number of qubits needed to solve commercially relevant problems. Multiple companies are now attempting to scale up trapped ion platforms, and early-stage quantum computers built by IonQ and Quantinuum are already accessible via the cloud for research and to build commercial use cases.

Principles of trapped ion quantum computing. Image source: IDTechEx.

A tale of two quantum startups

Founded in 2015, IonQ is one of the largest quantum computing startups, and arguably the largest using the ion trap modality, rivaled primarily by the Cambridge (UK) based company Quantinuum, which emerged from a merger of Honeywell and Cambridge Quantum Computing (CQC) in 2021.

In the last few months, IonQ has made multiple key acquisitions that culminated in this deal for Oxford Ionics. In May 2025, IonQ acquired ID Quantique, a global leader in quantum networking and communications. ID Quantique has pioneered the commercialization of quantum key distribution (QKD) and quantum random number generators (QRNG), expanding IonQ's quantum communications portfolio with mature, off-the-shelf solutions. ID Quantique's development of high-performance single photon detectors will also integrate into IonQ's model of photonic connectivity between quantum computing clusters. Other acquisitions include entangled photon source company Qubitekk in November 2024 and photonic interconnect company Lightsynq at the beginning of June 2025.

This roll-up of quantum companies represents IonQ's strategy to spread their capabilities across quantum computing, sensing, and communications, as well as an ongoing focus of IonQ to strengthen their capabilities in photonics, which play a key role in their system design.

Meanwhile, Oxford Ionics was founded in 2019 but has demonstrated excellent technical results in recent years, particularly in gate fidelities and error reduction. Over the last few years, Oxford Ionics' focus on demonstrating high qubit fidelities has seen them gain significant attention in the community. Before this acquisition, Oxford Ionics could be seen as the third largest major player in the trapped ion space in terms of technical capability.

In September 2024 they announced a record result in state preparation and measurement (SPAM) fidelity at 99.9993%, a lab result but nonetheless a promising sign of technical progress. However, the success of Oxford Ionics is not limited to experiments; the company has already delivered on premise solutions in contracts believed to be worth approximately £20M per system and has grown to over 75 FTEs in size. In 2025, Oxford Ionics claims to have reliably demonstrated qubit fidelities at their target of 99.99%, which would be a significant improvement over the error rates of many current qubit modalities.

However, the most important asset of Oxford Ionics for this acquisition may be in their proprietary manufacturing of ion traps. Through Oxford Ionics' collaboration with Infineon, they have developed on-chip microwave ion traps that can be manufactured in CMOS-compatible processes. This innovation works to alleviate one of the largest pain points in conventional ion traps by avoiding the need for complex arrays of lasers to control the trapped qubits.

Market outlook

This record-breaking deal represents a significant shift in the quantum computing market landscape. With this acquisition, IonQ shores up many of its previous technical limitations while consolidating talent and resources in the trapped ion computing space. This proves that the stakes in the quantum computing industry are now higher than ever as investment and competition continue to grow.

Even after this acquisition, the quantum computing market is still far from a monopoly. Several groundbreaking quantum startups and established giants like Microsoft and Google are all still in the running, with many pitching real commercial advantage from quantum computers within the next 5 years. IDTechEx's market report on the topic, “Quantum Computing Market 2025-2045: Technology, Trends, Players, Forecasts“, tracks the progress of tech giants, governments, and startups alike in developing commercially relevant quantum computers. This report provides an in-depth evaluation of the competing quantum computing technologies, the companies and initiatives driving them, and the key industries first to be impacted.